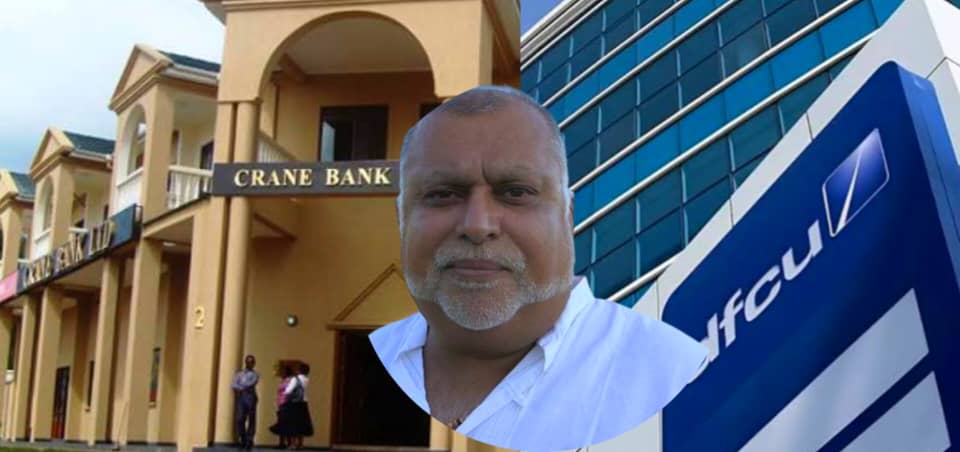

A Ugandan newspaper recently published a story claiming that billionaire Sudhir Ruparelia had been ordered by a UK court to hand over his mobile phone for forensic analysis. These claims are false, misleading, and not supported by the actual court ruling.

The judgment, delivered on July 24, 2025, by Justice Paul Stanley KC, Deputy Judge of the High Court in London, made no mention of such an order. The case primarily dealt with whether DFCU Bank could amend its defence to include conclusions from the PwC forensic reports. The court ultimately rejected DFCU’s attempt to use these reports as evidence because they lacked a proper factual basis.

“To the extent that DFCU wishes to plead, as factual allegations that it positively intends to prove, any of PwC’s specific conclusions, paragraph 24.4 attempts to do so in a way that is inconsistent with effective preparation for a fair trial,” the judge ruled.

The 42-page judgment, which contains detailed reasoning on pleading standards and document admissibility, makes no reference to Sudhir Ruparelia being required to submit his mobile phone. It also does not compel his daughter, Sheena Ruparelia, to hand over her private emails, as claimed by the newspaper. Legal experts close to the case have described the report as “fabricated conjecture” that misrepresents procedural details to create sensational headlines.

Instead, the court ruling limited DFCU Bank’s reliance on the PwC reports. The claimants, including Sudhir Ruparelia and other former shareholders of Crane Bank, had argued that the reports were inadmissible because PwC was not licensed under Ugandan law at the time and its findings lacked credible sourcing. The judge declined to adopt PwC’s conclusions as factual truth, emphasizing that doing so would interfere with the fairness of the trial.

“The PwC reports, whatever their merits, do not resemble a pleading,” the judge said, adding that they cannot be adopted wholesale as evidence of primary fact. The ruling was a significant blow to DFCU Bank’s defence strategy, narrowing its ability to rely on Bank of Uganda-commissioned reports to justify the controversial 2017 takeover of Crane Bank.

The claimants, led by Sudhir Ruparelia, allege that the sale of Crane Bank was conducted through a fraudulent process that undervalued the bank’s assets and transferred them to DFCU under the guise of regulatory action. This case has remained a major point of dispute in Uganda’s banking and investment sectors, highlighting questions around fairness and legal compliance.

For Sudhir Ruparelia, the judgment is a clear vindication. It confirms that media claims about him being forced to hand over his phone or emails are entirely false. The ruling reinforces his position that the takeover of Crane Bank was irregular and strengthens his ongoing efforts to hold the responsible parties accountable.

The case also underscores the importance of careful reporting and fact-checking. Legal analysts say the judgment demonstrates that DFCU Bank’s defence, which relied heavily on contested PwC reports, is weak, while Sudhir Ruparelia’s claims continue to be supported by the court’s careful review of evidence and procedure.

Through this ruling, Sudhir Ruparelia not only protects his personal and professional reputation but also highlights the broader principle that fair legal process must be followed, and that sensationalist media claims should not override the facts established in court.